By India Fills – Your Trusted Compliance Partner | www.indiafills.com

In today’s fast-moving world, many people and businesses need easy and fast access to loans, finance, and investment help. But not everyone can go to big banks and follow difficult processes. That’s where NBFCs come in.

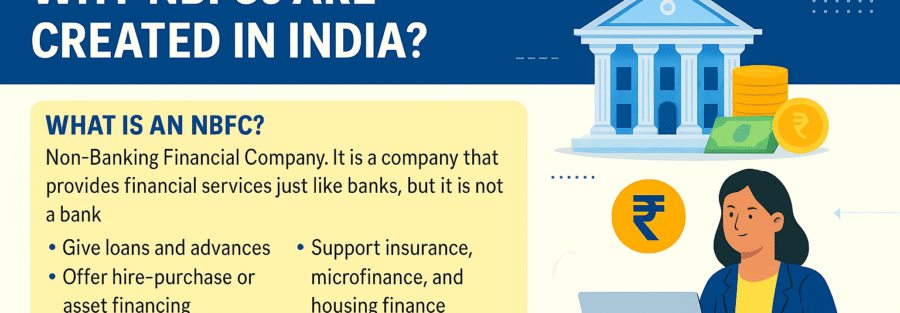

🤔 What is an NBFC?

NBFC stands for Non-Banking Financial Company. It is a company that provides financial services just like banks, but it is not a bank.

An NBFC can do things like:

- Give loans and advances

- Offer hire-purchase or leasing

- Provide investment and asset financing

- Support insurance, microfinance, and housing finance

- Help small businesses and startups grow

But one major difference is — NBFCs do not accept savings deposits like banks.

🏦 Why Are NBFCs Created in India?

India is a huge country. Not everyone lives near a bank or has the right documents to take a bank loan. Many people are:

- Small shopkeepers

- Auto drivers

- Farmers

- Women entrepreneurs

- People living in small towns and villages

NBFCs are created to support these people. They help in making money and financial services more reachable for the common man.

💡 How NBFCs Help the Economy

NBFCs are playing a very important role in India’s economy. Here’s how:

✅ Financial Inclusion

NBFCs reach people in rural and remote areas, where banks don’t reach. They help people get small loans for business, farming, or personal needs.

✅ Support to MSMEs

Micro, Small & Medium Enterprises (MSMEs) are the backbone of India. NBFCs give easy and quick loans to these businesses, so they can grow and provide more jobs.

✅ Innovative and Fast

NBFCs use technology and smart systems to give fast approvals, digital paperwork, and better customer service. You don’t always need to visit their office.

✅ Helps Grow New Sectors

NBFCs invest in real estate, infrastructure, education, vehicles, health, and more. So, they are helping many industries grow faster.

🛡️ Are NBFCs Safe and Regulated?

Yes, NBFCs in India are fully legal and registered with the Reserve Bank of India (RBI). RBI keeps strict rules and checks to ensure that NBFCs work honestly and safely.

There are different types of NBFCs, such as:

- NBFC-Investment & Credit Company (NBFC-ICC)

- NBFC-Microfinance Institutions (NBFC-MFI)

- NBFC-Factor

- NBFC-Housing Finance Company

- NBFC-Infrastructure Finance Company, and more.

Each type has its own work and benefits.

🌐 Want to Start an NBFC in India? Let India Fills Help You! 💼

Starting an NBFC requires RBI permission, proper documents, and many legal steps. But don’t worry — India Fills is here to guide and help you at every stage.

👨💼 Why Choose India Fills?

✅ Expert Consultants with 30+ years of experience

✅ PAN India service – from any city or state

✅ Full support from NBFC planning to post-approval

✅ Affordable pricing

✅ Quick and hassle-free process

📞 Call us or WhatsApp: +91 97322-27778

🌐 Visit us: www.indiafills.com

📧 Email us: indiafills@gmail.com

👉 Follow us on social media:

📘 Facebook: [Facebook Page Link]

📸 Instagram: [Instagram Page Link]

📢 Final Words

NBFCs are changing the way finance works in India. They are giving power to the people, especially those who were ignored by banks for years. Whether you are a businessman, investor, or someone with a dream — NBFCs can be your partner in success.

And if you wish to create your own NBFC, India Fills is ready to help you make it a reality!